oklahoma franchise tax due date 2021

Your Oklahoma return is due 30 days after the due date of your federal return. Oklahoma Franchise Tax is due and payable July 1st of each year or if you elected to change your filing date to be the same as the date of filing your corporate income tax the report and tax will.

Oklahoma Tax Reform Options Guide Tax Foundation

Oklahoma State Individual Taxes for Tax Year 2021 January 1 - Dec.

. The Oklahoma Tax Commission will waive penalty and interest on tax payments received between April 15 and June 15 2021 up to twenty-five thousand dollars 2500000. 31 2021 can be. Oklahoma franchise tax due date 2021 Tuesday June 7 2022 A mechanics lien or personal lien can be found by using an online public record.

LINE BY LINE INSTRUCTIONS. Simplify Oklahoma sales tax compliance. OK tax return filing and payment due date for Tax Year 2021 is April 18 2022Oklahoma State Individual Taxes for Tax.

INCOME TAX GENERAL INSTRUCTIONS FOR DETERMINING OKLAHOMA TAXABLE INCOME INCOME COMPUTATION. The Oklahoma Tax Commissioners decided to adjust the payment deadline extension from April 15 to June 15 for everyone who lives in or owns a business in Oklahoma. The Oklahoma franchise tax is due by July 1st each year.

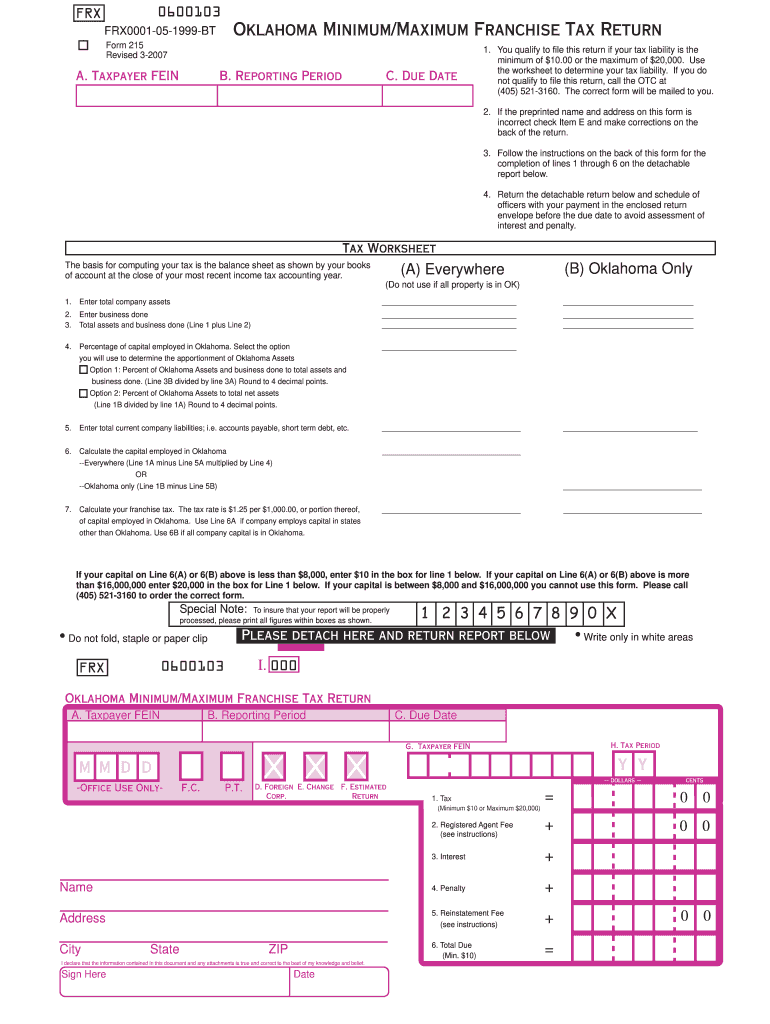

Effective November 1 2017 corporations who remit the maximum amount of 2000000 in the preceding tax year the tax will be due and payable on May 1st of each year and. We provide sales tax rate databases for businesses. See page 14 for methods of contacting the Oklahoma Tax Commission OTC.

OK tax return filing and payment due date for Tax Year 2021 is April 18 2022. The tax identity theft risk. Franchise Tax Payment Options New Business Information New Business Workshop Forming a Business in Oklahoma Streamlined Sales Tax Forms.

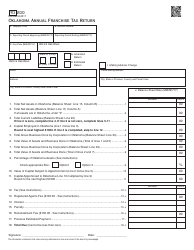

Registrants can change their entitys tax filing date to the same schedule of filing as their corporate income and franchise taxes. Any taxpayer with a payment due by March 15 2021 andor April 15 2021 for 2020 Oklahoma income taxes andor any estimated 2021 income tax payment due by March 15. Revised 9-2021Oklahoma Annual Franchise Tax Return FRX200 -Office Use Only- State of Incorporation G.

Multiply the amount in Line 12 by 0125 for each month the report. March 11 2021 Sales and Use Tax News Releases March 2021 Sales. If a taxpayer computes the franchise tax due and determines that.

2021 Payroll in Excel- Oklahoma Withholding Edition. For these corporations franchise tax is due and payable on May 1 of each year and delinquent if not paid on or before June 1. If this return is postmarked after the due date the tax is subject to 125 interest per month from the due date until it is paid.

Oklahoma franchise tax 2021 due date The ability to intuit how people see us is information Free In e Tax. Oklahoma franchise excise tax is levied and assessed at the rate of 125 per 100000 or fraction thereof on the amount of capital allocated or employed in Oklahoma. Estimated Return EOklahoma F.

Fill Free Fillable 2021 Form 512 Oklahoma Corporation Income And Franchise Tax Return Packet Instructions State Of Oklahoma Pdf Form

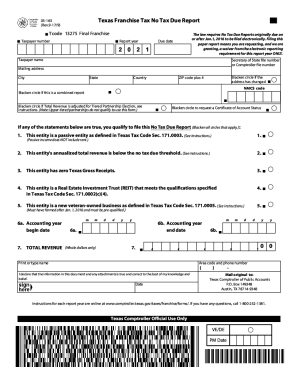

Texas Franchise Tax No Tax Due Fill Out And Sign Printable Pdf Template Signnow

Fill Free Fillable 2021 Form 512 Oklahoma Corporation Income And Franchise Tax Return Packet Instructions State Of Oklahoma Pdf Form

Fill Free Fillable 2021 Form 512 Oklahoma Corporation Income And Franchise Tax Return Packet Instructions State Of Oklahoma Pdf Form

Fill Free Fillable 2021 Form 512 Oklahoma Corporation Income And Franchise Tax Return Packet Instructions State Of Oklahoma Pdf Form

2021 Form Ok Frx 200 Fill Online Printable Fillable Blank Pdffiller

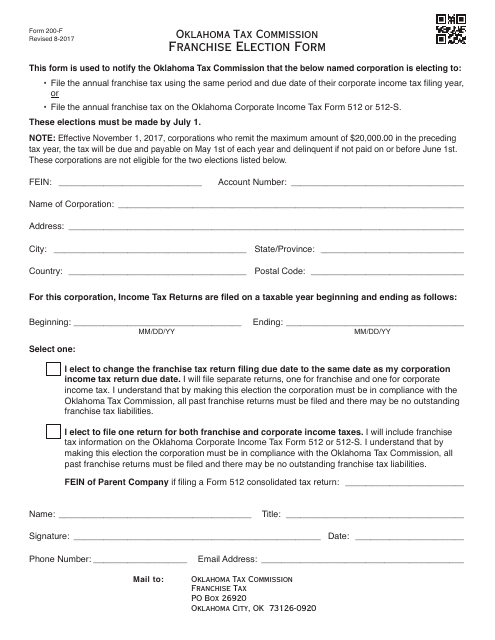

Otc Form 200 F Download Fillable Pdf Or Fill Online Franchise Election Form Oklahoma Templateroller

Oklahoma Form 512 Corporate Income Tax Return Form And Schedules 2021 Oklahoma Taxformfinder

Fill Free Fillable 2021 Form 512 Oklahoma Corporation Income And Franchise Tax Return Packet Instructions State Of Oklahoma Pdf Form

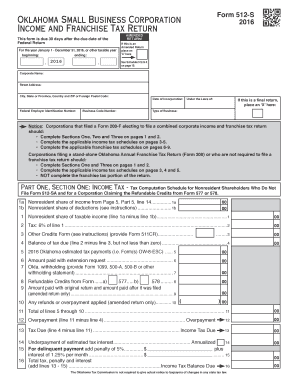

Fillable Online Form 512 S Fax Email Print Pdffiller

Fill Free Fillable 2021 Form 512 Oklahoma Corporation Income And Franchise Tax Return Packet Instructions State Of Oklahoma Pdf Form

Form 200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

Otc Form Frx200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

Otc Form Frx200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

How Failing To File Franchise Tax Returns Causes Personal Liability Texas Tax Talk

What Is Franchise Tax Overview Who Pays It More

2007 2022 Form Ok Otc 215 Fill Online Printable Fillable Blank Pdffiller

Ok Frx 200 2020 2022 Fill Out Tax Template Online Us Legal Forms

2007 2022 Form Ok Otc 215 Fill Online Printable Fillable Blank Pdffiller