colorado springs sales tax calculator

Multiply the vehicle price after trade-ins but before incentives by the sales tax fee. The December 2020 total local sales tax rate was 8250.

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Manitou Springs is located within El Paso.

. The Colorado sales tax rate is currently. Castle Rock CO Sales Tax. Sales Tax Return Changes The Sales Tax Return DR 0100 changed for the 2020 tax year and subsequent periods.

Some cities in Colorado are in process signing. S Colorado State Sales Tax Rate 29 c County Sales Tax Rate l. For Glendale residents the tax rate is 5 a month if you earn at least 750 during a calendar month.

The Colorado sales tax rate is 29 the sales tax rates in cities may differ from 325 to 104. To calculate the sales tax on your vehicle find the total sales tax fee for the city. Broomfield CO Sales Tax Rate.

Colorado state sales tax rate range 29-112 Base state sales tax rate 29 Local rate range 0-83 Total rate range 29-112 Due to varying local sales tax rates we strongly. Brighton CO Sales Tax Rate. In Sheridan youll be taxed 3 per month regardless of your wages.

Effective January 1 2016 through December 31 2020 the City of Colorado Springs sales and use tax rate is 312 for all transactions occurring during this date range. If you have a location in Colorado and make a sale to someone outside your district you collect the. City sales tax collected within this date range will report at 312.

In this section we provide a suite of Sales Tax Calculators one for each of the States that applies Sales Tax in 2022. AvaTax accurately calculates sales tax based on location item laws more. The Sales tax rates may.

January 1 2016 through December 31 2020 will be subject to the previous tax rate of 312. This site is now available for your review. The base state sales tax rate in Colorado is 29.

The average sales tax rate in Colorado is 6078. Just enter the five-digit zip. Local tax rates in Colorado range from 0 to 83 making the sales tax range in Colorado 29 to 112.

Colorado Sales Tax Lookup. Colorado has a 29 statewide sales tax rate but also has 277 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 4087. Sales Tax in Colorado Springs Colorado is calculated using the following formula.

Boulder CO Sales Tax Rate. The minimum is 29. The minimum combined 2022 sales tax rate for Colorado Springs Colorado is.

The average cumulative sales tax rate in Manitou Springs Colorado is 903. Effective January 1 2021 the City of Colorado Springs sales and use tax rate has decreased from 312 to 307 for all transactions occurring on or after that date. You can look up your combined local sales tax rate with TaxJars Sales Tax Calculator.

If your business purchased or. Ad Our tax calculator automates VAT other sales tax saving you time reducing audit risk. This is the total of state county and city sales tax rates.

Sales Tax Rate s c l sr Where. Motor vehicle dealerships should review the DR 0100 Changes for. Find your Colorado combined.

27 lower than the maximum sales tax in CO. Aurora CO Sales Tax Rate. Simply click on the State that you wish to calculate Sales Tax for.

The statewide sales tax in Colorado is just 290 lowest among states with a sales tax. AvaTax accurately calculates sales tax based on location item laws more. Groceries and prescription drugs are exempt from the Colorado sales tax.

The combined amount is. Welcome to the Sales and Use Tax Simplification SUTS Lookup Tool. This includes the rates on the state county city and special levels.

Ad Our tax calculator automates VAT other sales tax saving you time reducing audit risk. The 82 sales tax rate in Colorado Springs consists of 29 Colorado state sales tax 123 El Paso County sales tax 307 Colorado. Colorado Springs CO Sales Tax Rate The current total local sales tax rate in Colorado Springs CO is 8200.

However as anyone who has spent time in Denver Boulder or Colorado Springs can. The Colorado state sales tax rate is 29 and the average CO sales tax after local surtaxes is 744.

Sales Tax Information Colorado Springs

Cost Of Living In Colorado Ramseysolutions Com

Economy In Colorado Springs Colorado

Fort Carson Military Move And Area Guide Pcsgrades

Property Taxes By State Quicken Loans

State And Local Sales Tax Rates 2019 Tax Foundation

Sales Tax Information Colorado Springs

Another Income Tax Cut For Colorado In 2022 Maybe And It Could Cost The State Budget 400 Million Colorado Public Radio

Kansas Sales Tax Rates By City County 2022

How To Ensure The Right Sales Tax Rate Is Applied To Each Transaction

Colorado Springs Colorado Co Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

The San Diego County California Local Sales Tax Rate Is A Minimum Of 6 25

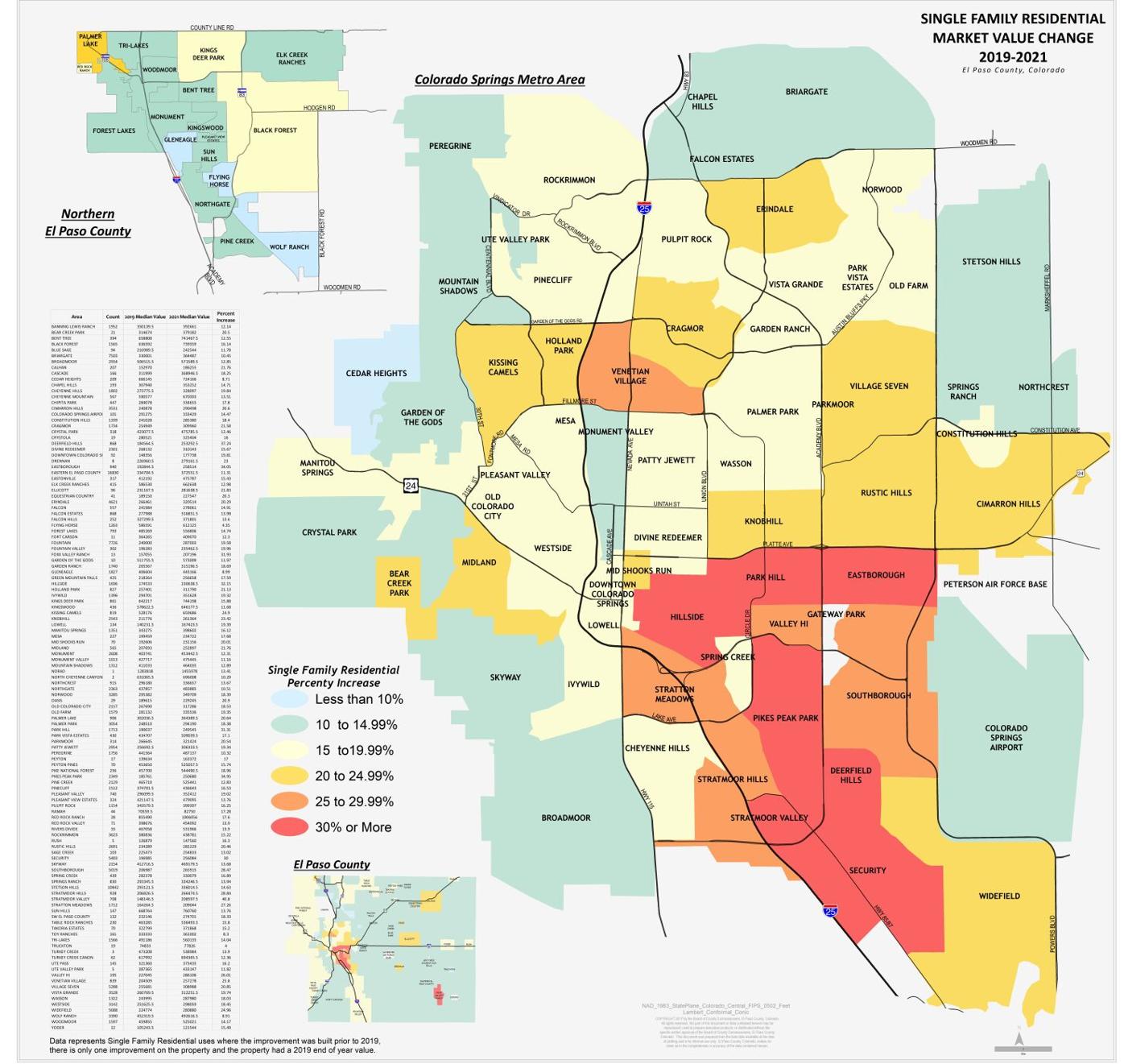

Increased Tax Bills Expected For Most El Paso County Property Owners Assessor Says News Gazette Com

Colorado State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

Use Tax Information Pikes Peak Regional Building Department

Colorado Sales Tax Calculator And Local Rates 2021 Wise

Understanding Your Property Taxes Springs Homes

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation